Warpaint London PLC: Watching Them Grow - FY23A Update

Cosmetics producer Warpaint London PLC (AIM: W7L) confirmed an outstanding FY23A with yet another set of strong results beating consistently raised expectations.

Cosmetics producer Warpaint London PLC (AIM: W7L) confirmed an outstanding FY23A with yet another set of strong results beating consistently raised expectations. This was driven by a good combination of strong sales growth, across geographies and in-stores/online, as well as margin expansions, and cash generation. It’s almost as if Oprah has been handing out W7L products at the end of her shows…

Growth mode: ON

W7L produced yet another strong set of financials with sales increasing 40% YoY to £89.6m, as a result of strong growth across geographies but more interestingly online. Online sales more than doubled to a total of £6.2m, whilst EU sales increased by c.60% to £45.1m, UK sales increased by 18% to £32.4m and US sales increased by 37% to £7.3m.

The growth in sales reflected both the strong performance with existing customers through increased ranges and stores (exciting update on this below) and new customer wins. And oh have W7L scored some Ws – we wonder if the W7L stands for 7 Wins and 0 Losses… guess only time will tell.

Gross margin increased 350bps to just shy of 40%, due to a combination of variables including freight tailwinds and sourcing, increased focus on everyday items and the benefits of new product development, which enable higher margins to be built into pricing.

The Company remains debt-free and thus has seen an immaterial impact from the higher interest rate environment. As such, diluted EPS growth was strong at 66% YoY with a full-year dividend payment of 9.0p (27% growth YoY) and EPS cover of 2.1x.

But wait there’s more!

As highlighted in our Initiating Coverage Report, we continue to see in-store presence as a key driver for growth. During FY23A, W7L continued its successful rollout strategy with:

The successful launch of the W7 product in an initial 71 Superdrug stores

With a further rollout into another 63 stores planned for July 2024

The successful trial of 20 New Look stores in 2022, followed by an additional rollout in 200 stores in 2023

The launch into 202 Morrisons stores in March 2024

The further expansion into another 100 Boots stores in April 2024

The expansion into a further 387 CVS stores

Significant Christmas order from Walmart for W7 and Chit Chat product to be stocked across all Walmart stores

Discussions ongoing to stock product all-year-round

The launch into 100 AS Watson stores

Significant growth planned in Five Below, targeting products in all 1,544 stores

Despite W7L having penetrated quite a few new stores in FY23A, there is still room for further expansion as seen in the graphic below. This remains the key catalyst for growth in our opinion.

How many colour palettes does one need?

As part of the FY23A update, we also received an update on 1Q24. The strong performance of FY23A continued into 1Q24 with sales increasing 28% YoY and gross margins remaining robust and above those achieved in FY23A, although no exact figure was provided.

To be able to deliver a full-range of cosmetics to its customers, W7L employees a policy of investing in inventory. FY23A inventories were 47% higher YoY, with a further focus on inventory taking place in 1Q24 to support anticipated growth – particularly the potential for all-year-round product stocking in Walmart. For context, whilst cash on balance was £9.1m at FY23A, this reduced 17.5% to £7.5m in 1Q24 as a result of inventory purchasing.

Whilst this does pose risks to working capital, we see the ongoing investment in inventory as a significant barrier to entry for new entrants into the affordable colour cosmetics segment which W7L operates in.

Strat W7L

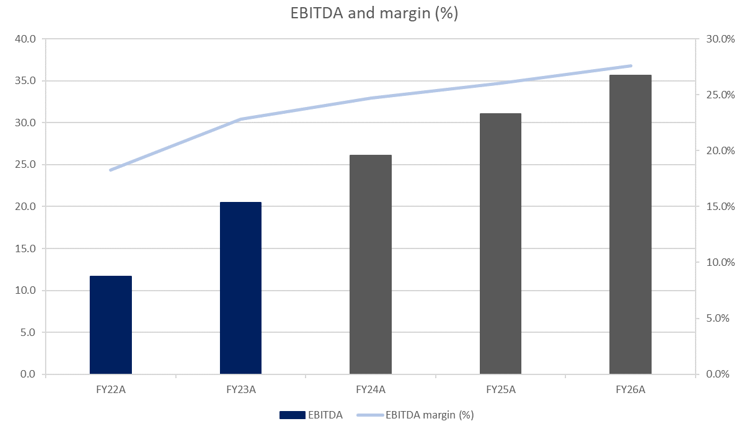

In January 2024, the Board provided a strategic plan update forming the basis of the Group’s focused activity through to 2026. We are supportive of the plan, and pleased to see a public company with a short-term, unleveraged, feasible strategy to growth. The plan is centred around generating shareholder value and has defined targets for sales and incremental EBITDA growth.

We are incredibly pleased to see the Group set focus on increasing US market share. We see the US market as a key catalyst for growth due to it being more than 10x the size of the UK market. That being said the UK does remain the core market of the Group, with management seeking to capitalise on consumers and retails across all sectors.

In line with expectations, close-out sales are no longer a core focus of the Company, although they will take advantage of profitable close-out opportunities, as and when they become available. Close-out sales now represent 2.8% of overall sales compared to 5.9% in FY22A.

Further in line with the Group’s debt-free profile, Sam Bazini (CEO) and Eoin Macleod (MD) sold in aggregate 7m ordinary shared in W7L at a price of GBX 450, raising aggregate gross proceeds of £31.5m. This was largely oversubscribed, initially targeting 6m ordinary shares, and was strongly supported by both existing and new institutional investors. Given the Group’s growth ambitions and debt-free aim, we remain supportive of managements capitalisation strategy.

Re-applying setting spray

As a result of all the above, we have updated our blended target price[1] to GBX 600, up from GBX 549, resulting in a 22% upside to May 24th close. This utilises a WACC of 8%, long-term growth rate of 2.5% and EV/EBITDA multiple of 12.0x - alongside some other marginal improvements in margins (due to reduction in inflationary pressures), and net working capital.

We would like to also note that, since our Initiating Coverage Report, W7L has materialised c.70% of our initial target price, with YTD total returns of 31% as of May 24th close.

If you are a patient investor in Warpaint, buying upon any dips in the price, then we believe that you will be onto a winner.

Foundation laid, time to glow

Overall, Warpaint’s balance sheet continues to remain strong and with ample financial resources to support its medium to long-term growth ambitions. We remain excited to see the Company realise its potential and note that the presence of W7L product in Walmart stores all-year-round could be a vital acceleration point in the Group’s growth story. We therefore remain supportive of the Group’s growth strategy and the subsequent tailwinds to earnings.

[1] Gordon growth and multiples approach.